Why Refinance your Ontario Canada Mortgage?

Now is a great time to refinance your Ontario Mortgage with Mortgage interest rates at their lowest. Many Canadians are taking advantage of this and applying for mortgage refinancing. For some it is a matter of being able to keep on track with their financial goals and of course save thousands of dollars in unnecessary interest payments. For others it’s a way of financing a luxury item such as a new boat, cottage or even a world cruise. Maybe you just feel like your finances are just a constant revolving door – money in your wallet one minute and gone the next! If you feel like you are just never getting ahead and are losing sleep, then a refinance could be the relief you need.

Why refinance? By using the equity in your home, refinancing your existing mortgage can be very advantageous and turns your home into a affordable source of extra financing. Here are some examples:

• To improve your most important assist - your home. Use equity in your home and a low interest mortgage refinance to renovate! This is an excellent way to increase the market value of your home

- To reduce your monthly payments. Consolidate high interest credit cards and other loans into ONE lower rate, monthly mortgage payment. Mortgage refinancing will help you save money, increase your monthly cash flow and eliminate the stress of making multiple loan payments

- To purchase an investment property using existing equity in your current home

- To top-up your RRSP investments and at the same time receive an income tax credit!

- To lower your existing mortgage interest rate. By reviewing your current credit rating and debts, there might be an opportunity for you to take advantage of your credit score improvements to refinance an existing high interest mortgage.

- To buy a big ticket item at a lower interest rate that more traditional financing e.g. auto financing, or personal loans etc.

- To help pay for your child's college or university tuition

- To help finance the care of an elderly family member or cover medical expenses

- To build your home equity faster. If a recent change in your financial situation has made it possible for you increase your monthly payments, you might want to refinance your mortgage with a shorter term. The higher payments will enable you to pay off your home more quickly and to save substantially on long-term interest charges.

Home Equity Loan Canada

Taking a look at refinancing could lead to financial independence sooner that you think. Together we can review your current financial situation and provide you with some options including a monthly budget. You may be able to quallify for a home equity loan and borrow as much as 95% of the value of your home and reduce your monthly payments by half with just one low payment. If you want to get ahead, then a refinance or debt consolidation could be the answer.

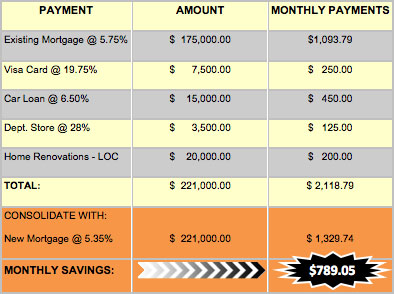

The following is an example of how you are able to save each month by refinancing and using your equity in your home to lower your monthly payment and increase your cash flow in Ontario, Canada.

Mortgage Refinancing Basics

Weigh the costs and benefits of mortgage refinancing to determine if you'll come out ahead.

Your mortgage may have a 5-year term, but not many homeowners stay with the same mortgage for that long. In fact, the average homeowner refinances his or her mortgage every four years, according to the Mortgage Bankers Association. That's because paying off your present mortgage and taking out a new one can mean big savings over several years. However, mortgage refinancing comes with a price in the short term, so it's important to consider both the costs and benefits before making your decision.

Should You Refinance Your Mortgage?

If you're refinancing in order to pay less interest, you won't usually see the savings right away. That's because there might be some charges applicable when you take out a new mortgage, and you may also have to pay a penalty for getting out of your old one. To determine whether refinancing makes financial sense for you, we will consider all of these issues:

• How long you plan to be in your home. If you expect to move in the next six months to a year, you may never realize the potential savings you'd get from refinancing. As a rule of thumb, the longer you plan to stay in your current home, the more sense it makes to refinance. However, if you do plan to move, we can ensure that the new mortgage has the option of “porting” to your new home – just as you pack up your furniture and take it with you, you can do the same thing with your mortgage known as a “port”.

• The prepayment penalty on your current mortgage. Many mortgages carry a penalty if you pay them off early. The amount varies, but it is usually a small percentage of the outstanding balance, or several months' worth of interest payments.

• The costs of the new mortgage. When you take out a new mortgage, there may be a number of fees including appraisal fee, title search, insurance and legal costs. You will be made fully aware of all fees and costs up front before you decide if its right for you. Our goal is to ensure any additional costs are either paid for by the lender, or you receive them back in savings in a matter of months.

Home Equity Loan - calculating the break-even point. In the end, deciding whether the cost of mortgage refinancing is worth it comes down to answer one simple question: How long will it take before I start to save money? In theory, this is a simple calculation. You start with the amount you will save by lowering your monthly payment. Then you add up all the costs associated with refinancing and divide the total by your monthly savings. This will reveal the number of months it will take to reach the break-even point.

For example, let's assume that refinancing would lower your payments from $2,000 to $1,400 (for a savings of $600 per month) and your prepayment penalty, and closing costs add up to $3,500. Divide $3,500 by $600 and you can see that it will take just under 6 months to realize the savings.

Refinancing can also protect you from rising interest rates

If you are concerned that rising interest rates in the future will make your monthly payments hard to handle? Consider mortgage refinancing now while the rates are very low.

You can't control interest rates, but you can protect yourself when rates are on the rise by refinancing your existing mortgage into a fixed term and payment for as long as 10 years. So if you are currently on a variable rate mortgage, chances are it currently offers a lower interest rate than a fixed-rate mortgage right now. However, if monthly payment increases have become more difficult than you bargained for, or you're concerned that further jumps will seriously strain your budget, you may want to consider refinancing to a fixed-rate mortgage. The rate you'll get may be somewhat higher than your current mortgage rate, but you'll have peace of mind -- your monthly payment will be consistent for the entire term of the mortgage, and you can budget accordingly. |